Your international gateway to U.S. and global markets

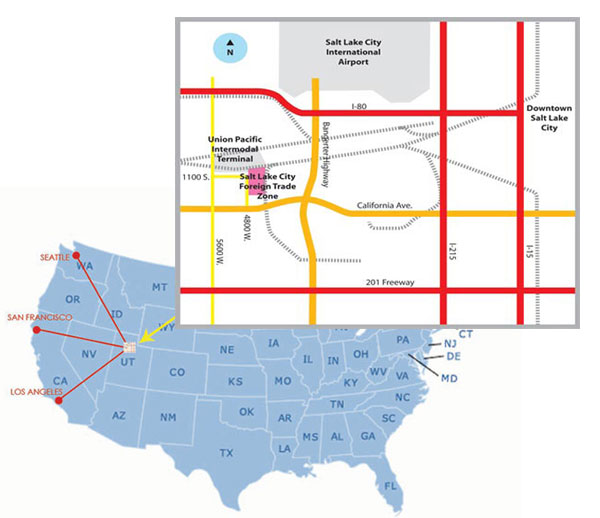

Salt Lake City, often referred to as the “Crossroads of the West,” is a hub for air, ground and rail distribution services located almost equidistant from all major Western U.S. markets. Salt Lake City International Airport is within a 2.5 hour flight of half of the population of the U.S. and ranks as the 22nd busiest airport in the U.S. with more than 970 flights daily. Utah’s road transportation system includes the distribution arteries of interstate highways I-15, I-80, I-70 and I-84. It has approximately 1,700 miles of railroad tracks that converge in the Salt Lake – Ogden metropolitan area.

Locating or expanding your company’s operations into a Foreign Trade Zone is a smart business strategy. When operating from an FTZ, your company gains a distinct competitive advantage by receiving cost reductions in customs duties and fees, a strategic location and supporting services.

Advantages of Salt Lake City’s FTZ #30

By bringing your international shipments into the Salt Lake City FTZ, you may be able to defer any applicable customs duty and federal excise taxes until the merchandise leaves the zone to be consumed in the U.S. This is an excellent way to lower the cost of holding inventory until you’re ready to ship to market. FTZ benefits include:

- No time constraints on storage

- Satisfy exportation requirements

- Increase security and lower insurance costs

- Potentially avoid supply chain delays

- Reduce dutiable tariff on imported parts when assembled in finished products

- Consolidate customs reporting

- Reduce fees with direct delivery and weekly entry

How much money could your company save?

Does your business location qualify?

To take advantage of the Salt Lake City Foreign Trade Zone, your business must submit an application and qualify for membership. Your business may either locate to the physical location of Salt Lake City FTZ #30 or be located within a 60 mile radius.

Salt Lake City’s FTZ recently entered into the Alternative Site Framework (ASF) which allows for faster processing. The benefits provided by this new framework will be accessible to any company within a 60-mile radius of the current FTZ located near the Salt Lake City International Airport. This area encompasses all of Salt Lake, Utah, Davis, Weber and Morgan Counties as well as parts of Box Elder, Summit, and Tooele Counties. Businesses not located within the physical location of FTZ #30 simply submit a special subzone application.

For more information on how your business can benefit from being located in FTZ 30 or as an FTZ Subzone, contact Peter Makowski at Peter.Makowski@slcgov.com.